Nvidia, Export Controls, and The Trump Team's Art of Trading on Insider Knowledge

A perfectly timed Nvidia put trade preceded Trump’s export controls by hours—and paid off by over 600%. In a month already shadowed by suspicious options activity, this one raises new questions.

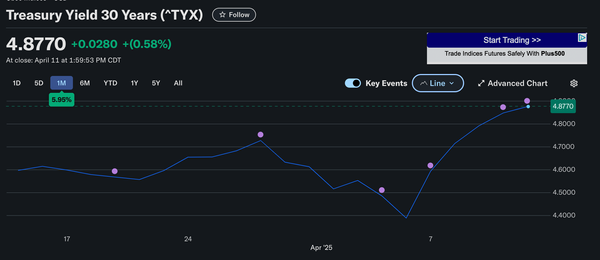

At first glance, today's 6.3% after-hours drop in Nvidia’s stock might not raise alarms. News moved the market. The Trump administration, after initially pausing restrictions following a Mar-a-Lago dinner with Nvidia’s CEO, reimposed permanent export controls, effectively banning Nvidia’s H20 chips from being sold to China. Nvidia now faces a $5.5 billion charge. The market responded predictably: sell.

But something strange happened before that. Between 1:10 and 1:25 pm EST, a cluster of aggressive put option trades targeting Nvidia crossed the tape.

Based on available trading data, these trades were tightly concentrated in this 15-minute window, with several large volume spikes at 1:13 and 1:22 pm specifically targeting short-dated puts.

No similar volume was observed earlier in the day. These weren’t part of a broader trend. They were specific. Targeted. And unusually well-timed. Within hours, those puts rose from roughly $0.90 to over $6.50 — a gain of more than 600%, based on observed volume and after-hours pricing data.

That alone might not be suspicious. Traders get lucky. But this isn’t the first time in April that we've seen this pattern. In fact, it looks a lot like April 9.

On that day, someone placed massive SPY call bets 32 minutes before Trump’s surprise tariff announcement. Those trades turned $100,000 into $3.6 million in under three hours. The math showed it wasn’t just improbable. It was nearly impossible.

Today, something subtler unfolded. But the question remains the same: who knew what, and when?

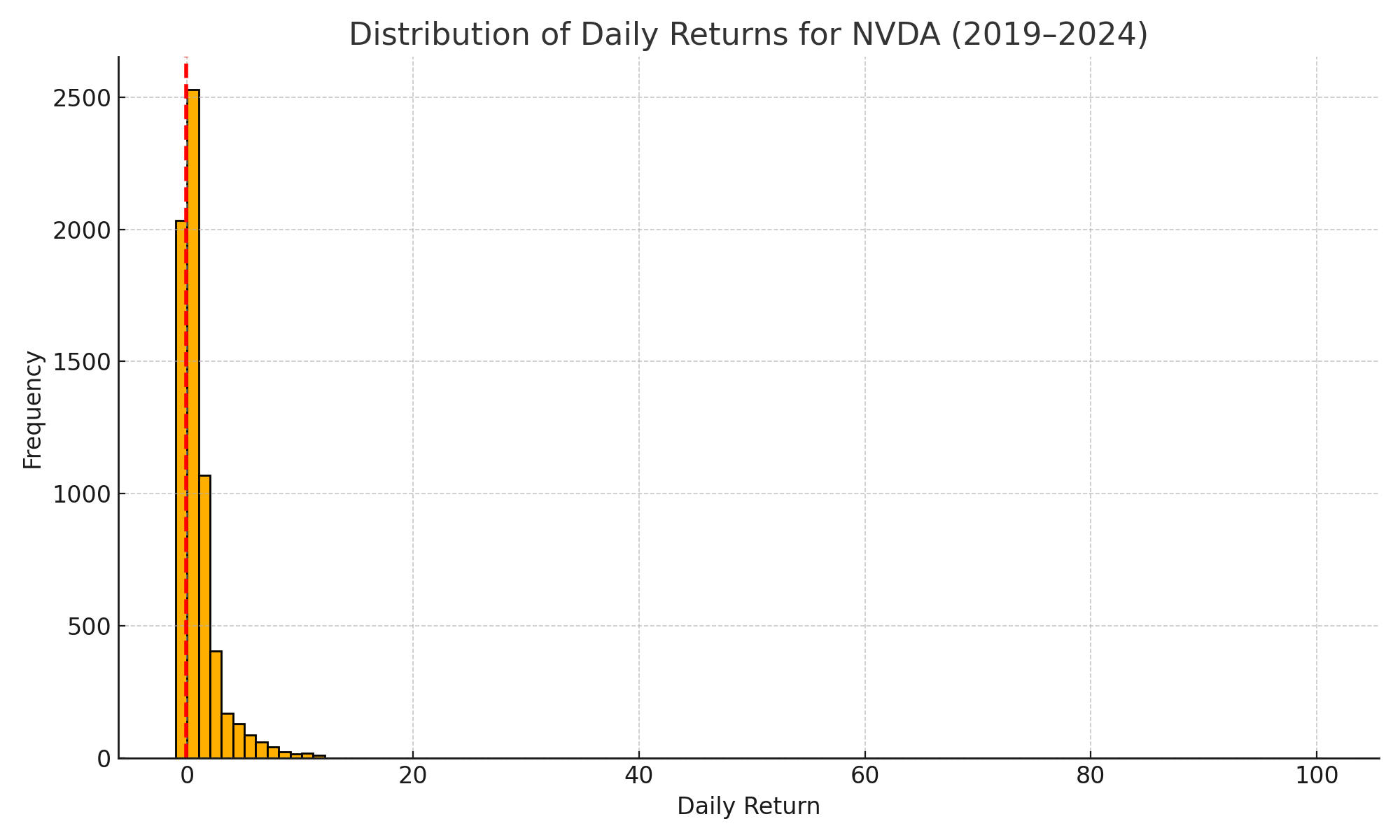

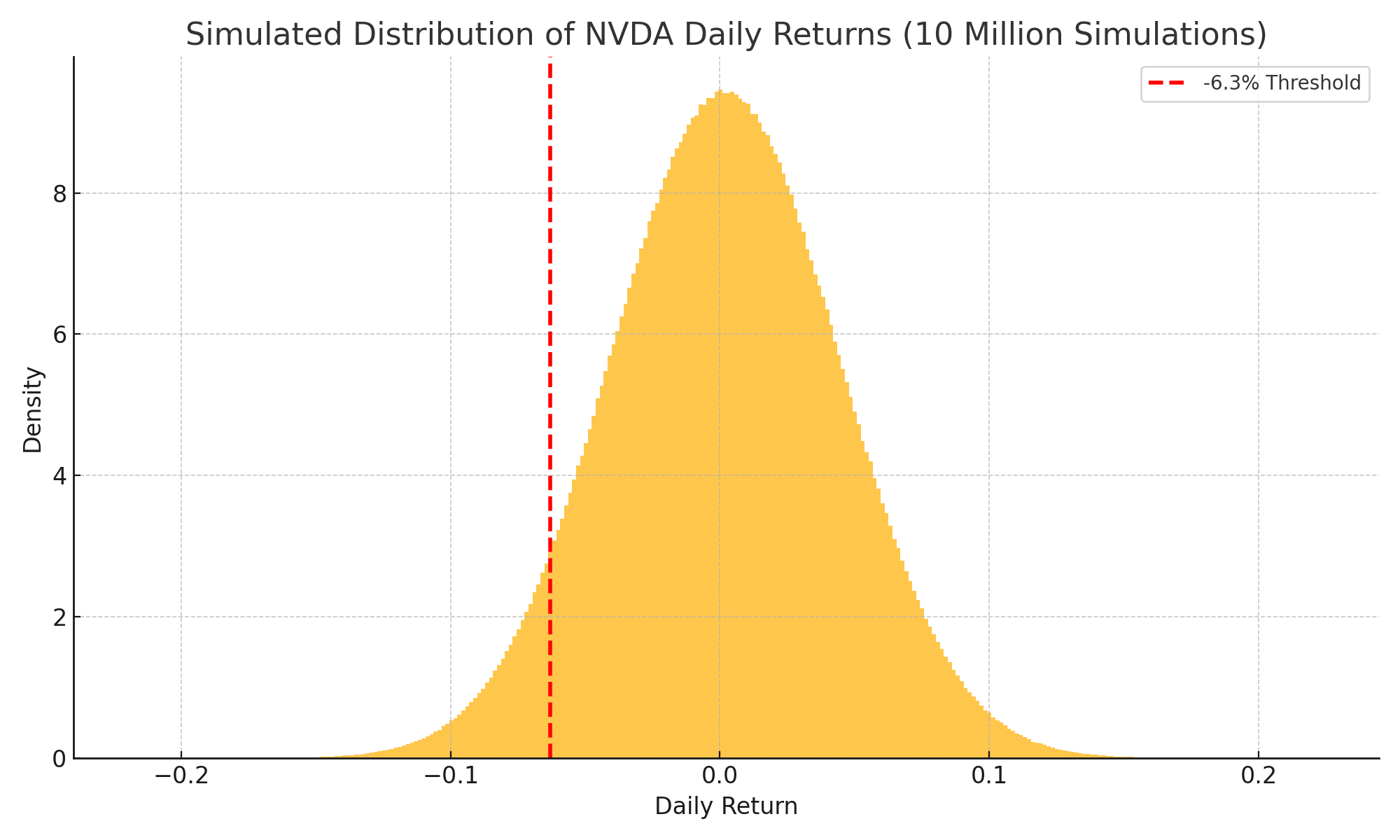

To understand how unlikely these Nvidia trades were, I used the same method I applied to SPY on April 9: a Monte Carlo simulation of price movements based on five years of historical data.

I simulated 10 million hypothetical trading days using Nvidia's historical daily returns from 2019 to 2024, calculating mean and volatility from close-to-close percentage changes. The simulation assumed a normal distribution of returns and did not incorporate intraday volatility or after-hours pricing. and asked: How often would Nvidia fall 6.3% or more in a single day? And how often would those gains concentrate so quickly — within just a few hours of afternoon trading?

The answer was clear. A drop of this magnitude, this quickly, is rare. Over the past year, there were 8 trading days when Nvidia fell by 6.3% or more — confirming that such drops are rare, but not unprecedented. and even fewer timed with such precision.

Now here’s the crucial detail: These put trades weren’t placed in the morning. According to the screenshots, the largest volumes appeared between 1:10 and 1:25 pm EST, with pronounced spikes at 1:13 and 1:22 pm — just hours before the export control announcement. They were placed just hours — some within minutes— before the news dropped. That timing matters. The closer a trader is to the event, the cheaper the options become and the higher the potential return. But it also increases the risk of getting caught.

Unless, of course, they knew the news was coming.

Could it be a hedge? A lucky guess? Sure. But every time I rerun the data, I come back to the same conclusion. The odds of making that kind of money, that fast, with that timing, in isolation — aren’t good.

And as I learned on April 9, when traders buy large, concentrated, short-dated options contracts just before news hits, it’s not usually a coincidence. It’s a signal.

One trade can be luck. Two in the same month? That’s something else entirely.

I’m not alleging anything. But if the SEC and CFTC aren’t already watching this tape, they should be.

Because once again, someone seems to know how the story ends before the first headline drops.

Disclaimer: I have no knowledge of any actual insider trading. This analysis is based on publicly available market data and statistical modeling. All observations are speculative and intended to raise questions and not make accusations.