Empty Ships, Empty Promises: Trump's Tariffs Are About to Decimate American Shipping

Trump's 145% tariffs triggered a flood of imports—but not a rise in American exports. West Coast ports are now sending ships back empty. This imbalance isn't just economic—it's personal. Jobs, wages, and trade flows are all at risk. The ships are still moving. But fewer are coming back.

In the months leading up to Trump's 145% tariffs on Chinese goods, US ports — especially on the West Coast — saw a dramatic surge in inbound shipments. Importers rushed to front-load goods from Asia, trying to beat the clock before new taxes hit. From February to March 2025 alone, loaded imports at the Port of Los Angeles rose by 19.3%. Long Beach imports jumped even more dramatically, with a 25.8% increase to 380,562 TEUs in March 2025 compared to the previous year. Oakland reported a 14.8% increase in loaded imports over the same period. Tacoma and Seattle (operating jointly as the Northwest Seaport Alliance) also saw a combined rise of 11.2%.

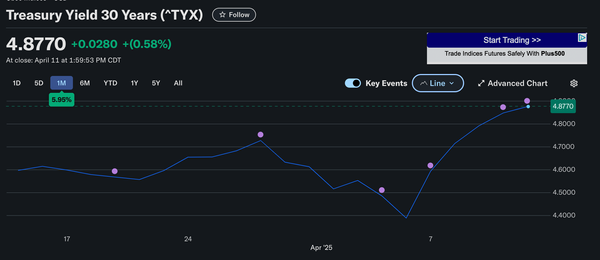

The uncertainty created by Trump's tariffs has caused dramatic swings in container shipping rates. The average spot rate to ship a 40-foot container from the Far East to the US West Coast jumped 16% in a single day to $2,844 in early April 2025. Shipping routes from alternative manufacturing hubs saw even steeper increases, with rates on the Ho Chi Minh City to Los Angeles route climbing 24%, reflecting desperate attempts by importers to secure transportation before tariffs took full effect.

But this surge in imports wasn't matched by exports - quite the opposite.

Export volumes at Los Angeles fell 15.02% month-over-month. At Long Beach, loaded exports dropped by 1% to 104,063 TEUs. Oakland exports declined by 4.2%, and Seattle/Tacoma exports grew by 8.1% in 2024 but still lagged far behind import growth of 19.6%. With Trump's tariffs creating serious economic disruption, US exporters face a double challenge — retaliatory tariffs from trading partners and fewer incoming ships available to take their goods to market.

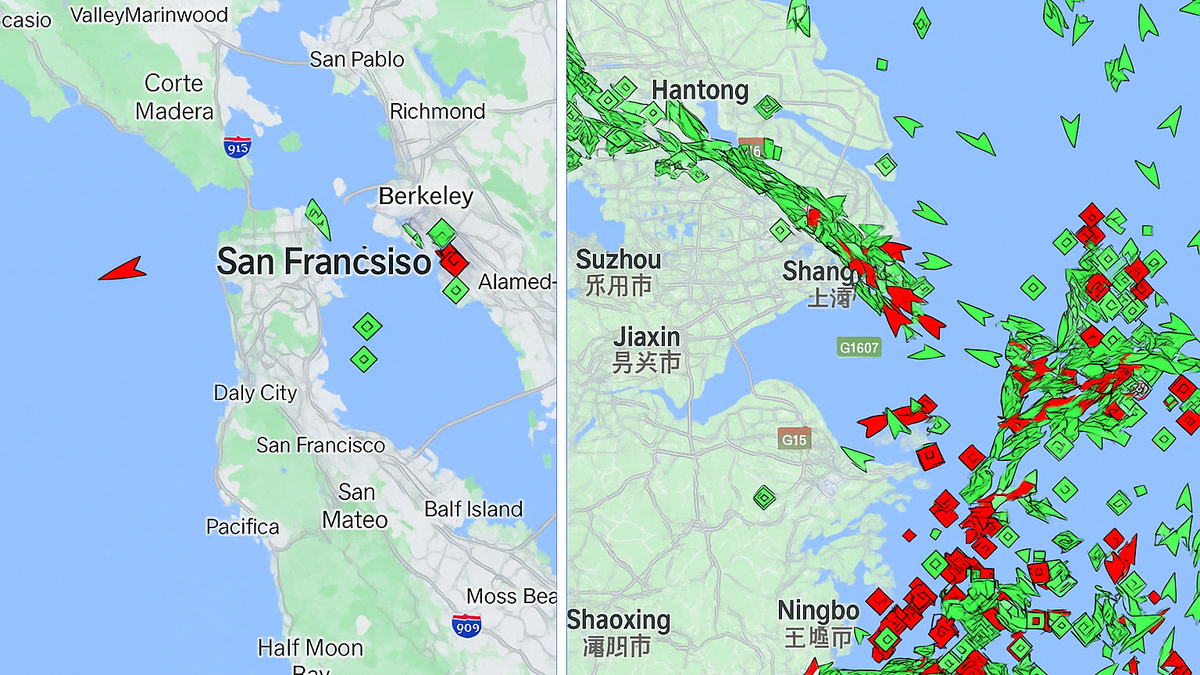

The most striking sign? The number of empty containers leaving American ports. At Los Angeles, empties increased 23.15% in March. Long Beach saw a dramatic 35% rise to 332,832 TEUs. Empties at Oakland climbed 19.6%, and Seattle/Tacoma reported a 15.2% increase. Ocean carriers now report increasing "blank sailings" (canceled shipments) out of China as orders plummet in response to the trade war. These cancellations mean fewer vessels available for American exports, potentially exacerbating the empty container problem in coming months.

This isn't normal friction. It's a signal of systemic imbalance.

Meanwhile, Chinese export volumes showed early signs of decline in April 2025. According to China's General Administration of Customs, exports to the US fell by 8.7% year-over-year. China has responded to Trump's 145% tariffs with its own 125% tariffs on all US goods, essentially making bilateral trade prohibitively expensive. Recent data shows China's exports to the US rose 9.1% in March 2025 while imports from the US fell 9.5% year-over-year, further widening the trade imbalance. Chinese exporters engaged in significant "frontloading," with overall exports jumping 12.4% in March as businesses rushed shipments before tariffs took full effect.

Maritime analysts have reported more than 80 blank sailings out of China, with major ocean carriers suspending or rerouting transpacific services due to falling demand.

This reinforces the picture: American companies over-ordered imports ahead of tariffs, but foreign buyers did not increase their demand for American exports. And Chinese firms — facing uncertainty — have already begun pulling back.

In a healthy trade environment, ships arriving full of imports leave carrying American exports. When they don't, it means either: 1) nobody wants what we're selling, or 2) we never planned to sell more in the first place.

Trump's tariffs were supposed to reduce the trade deficit by boosting American exports and cutting dependence on Chinese goods. What happened instead was a rush to import everything possible — and no corresponding increase in outbound trade. The result? More ships, more containers, and more space going home empty.

This is more than inefficient. It's an indictment of a trade policy that promised revival and delivered imbalance.

The Human Cost: Jobs That Depend on Trade

For the past decade, the growth of US ports has meant more than just higher throughput. It has meant jobs — thousands of them. Longshore workers, truck drivers, warehouse staff, rail operators, freight forwarders. When ships arrive full and leave full, Americans get paid at every step.

But that only works if trade flows in both directions.

Trump's tariffs have disrupted that balance. The front-loaded import surge created a temporary illusion of activity: more containers, more hours, more work. But it's a temporary boost. Once the rush ends and tariffs bite, the downturn begins.

Beyond the immediate employment impacts, additional measures threaten to compound the disruption. Beginning October 14, 2025, Chinese-built vessels will face fees of $50 per net ton when docking at US ports, escalating to $140 per ton by 2028. These fees could push some already struggling businesses past breaking points, with some importers reporting tariff increases from 6% to over 110% on certain goods.

We're already seeing early signs. The spike in empties means fewer goods to load, fewer containers to reposition, and less overtime on the docks. It also means inefficiency: equipment returning unused, chassis sitting idle, and truckers losing round-trip revenue.

The economic impact extends throughout the economy. Economists estimate the tariffs will reduce after-tax income by an average of 1.2% and amount to an average tax increase of approximately $1,243 per US household in 2025. These costs ripple through the economy both as higher prices for goods and as job losses in trade-dependent sectors.

And the danger isn't just fewer shifts or lower pay. It's job loss.

Historically, declines in container volume have tracked closely with trucking employment levels. During the COVID trade collapse of early 2020, the US lost over 80,000 trucking jobs in a matter of months. The 2015 West Coast port slowdown led to temporary layoffs and wage cuts across logistics hubs.

The warehousing sector also took a hit. According to BLS data, warehousing and storage employment dropped by over 47,000 jobs between March and May 2020 as import volumes and e-commerce demand collapsed. While these losses were later recovered, the initial contraction was severe and reveals how quickly logistics employment reacts to trade slowdowns.

The current situation may not be as sudden. But it's just as structural. Because this isn't about a pandemic or a labor dispute. It's about deliberate policy.

Trump is not just taxing goods. He's reshaping the rules of trade. And unless those rules include a plan to replace the work that trade creates, the costs will be borne by the very workers he claims to defend.

Empty Ships, Empty Promises

Trump's trade war was supposed to help American workers. It was supposed to bring jobs back. Rebalance trade. Punish China.

Instead, the data tell a different story.

Imports surged — not because of new demand, but because of fear. Companies rushed to front-load goods before tariffs hit. Exports? They didn't budge. Ships left our ports empty. And the industries that depend on outbound trade — trucking, warehousing, logistics — are bracing for the slowdown.

Looking ahead, the current import surge is already giving way to pessimistic forecasts. According to UBS Wealth Management, the new tariffs could cause import volumes to decline by 1.0-1.5% over the next three years, with long-haul container traffic from Asia to the US potentially declining by as much as 8%. S&P Global Market Intelligence expects this decline to materialize quickly, projecting a 0.7% drop in US ocean container freight imports for 2025, with growth in the first quarter reversing sharply in the second quarter "as tariffs bite."

This isn't how trade works. And it's not how trade policy should work.

A real strategy for reshaping global commerce would come with investment, transition plans, and support for workers. It would build and not just block. But what we've seen so far isn't strategy. It's spectacle. Punishment without preparation. Disruption without design.

And for every empty ship leaving Long Beach, Oakland, or Seattle, there's a missed opportunity inside it. Goods not sold, jobs not filled, wages not earned.

The trade deficit hasn't shrunk. The economy hasn't reindustrialized. But the damage is already underway.

Because eventually, the ships stop coming altogether.

And when they do, we'll have to reckon with the costs of a trade war waged with no map, no goal—and no plan for what comes after.