3,500% Returns In 3 Hours: The Extreme Case of April 9, 2025

At 12:58 pm EST on April 9, 2025, someone placed perfectly-timed SPY options bets just 32 minutes before Trump's surprise tariff announcement. These $0.85 contracts soared to $31 each by closing bell. A $100,000 bet became $3.6 million in hours. The odds? A 1-in-4,484 chance of even minimal profit.

At 12:58 pm EST on April 9, 2025, someone placed perhaps the most perfectly-timed options bet in recent market history. Just 32 minutes before Trump's surprise tariff announcement, thousands of SPY call options with a 509 strike price flooded the order book.

These weren't small, cautious positions—they were massive, targeted bets, set to pay off only if the market surged dramatically in the final hours of trading.

The timing couldn't have been more perfect. And the payoff? Nothing short of extraordinary.

Those 509 call options traded for pennies — just $0.85 per contract — when SPY hovered around $500. By the closing bell, after Trump's announcement catapulted markets to $548.62, those same contracts closed at $31 each. A modest $100,000 bet became $3.6 million in less than three hours.

A staggering 3,500% return. In one afternoon.

The critical question isn't whether this trade was profitable. Clearly, it was life-changing. The real question: how plausible was it to time this trade so precisely without prior knowledge? The analysis reveals two improbable outcomes:

- A 1-in-4,484 chance that SPY would even reach the $509 threshold required to generate any profit.

- Virtually impossible odds for SPY to reach $548.62, producing the enormous returns actually observed.

Why This Matters

Markets are unpredictable by nature. Yes, traders occasionally get lucky—but rarely on this scale, with timing this precise.

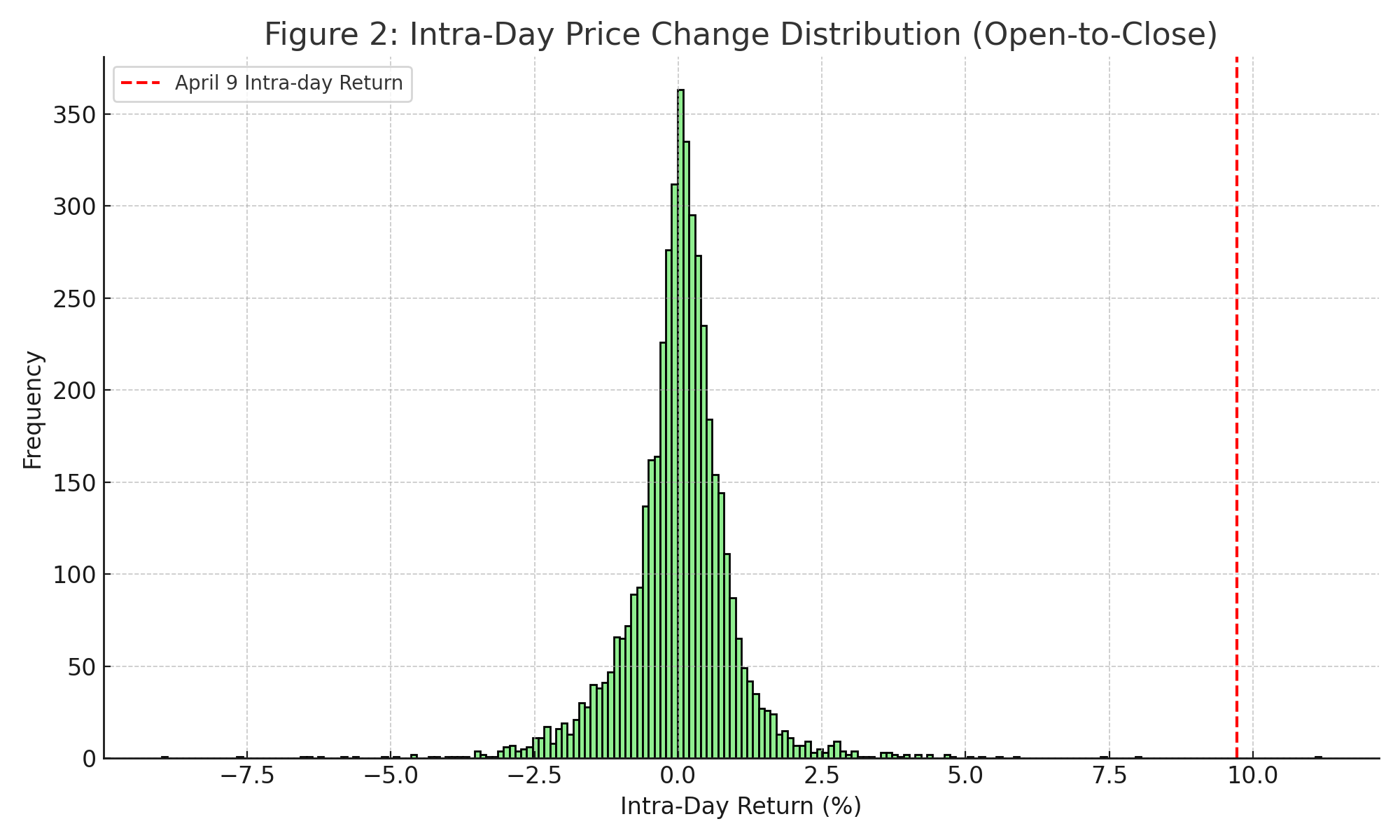

To understand how unlikely this was, I performed a Monte Carlo simulation using five years of SPY price history. This technique generates millions of hypothetical market days, based on historical returns, to estimate probabilities of extreme price moves.

How Rare Was the Trade?

Specifically, I examined: How often, historically, did SPY rise by at least 1.8% from midday ($500) to market close ($509 or higher)?

The result: Roughly once every 4,484 trading days—about once every 18 years.

Figure 1: Distribution of Simulated SPY Closing Prices (Starting from $500)

After simulating 10 million trading days, fewer than 1 in 4,484 scenarios reached or surpassed the necessary $509 threshold for profitability on the April 9 trade.

But reality went even further—the SPY didn't just stop at $509; it soared to $548.62. This unprecedented move amplified profits exponentially.

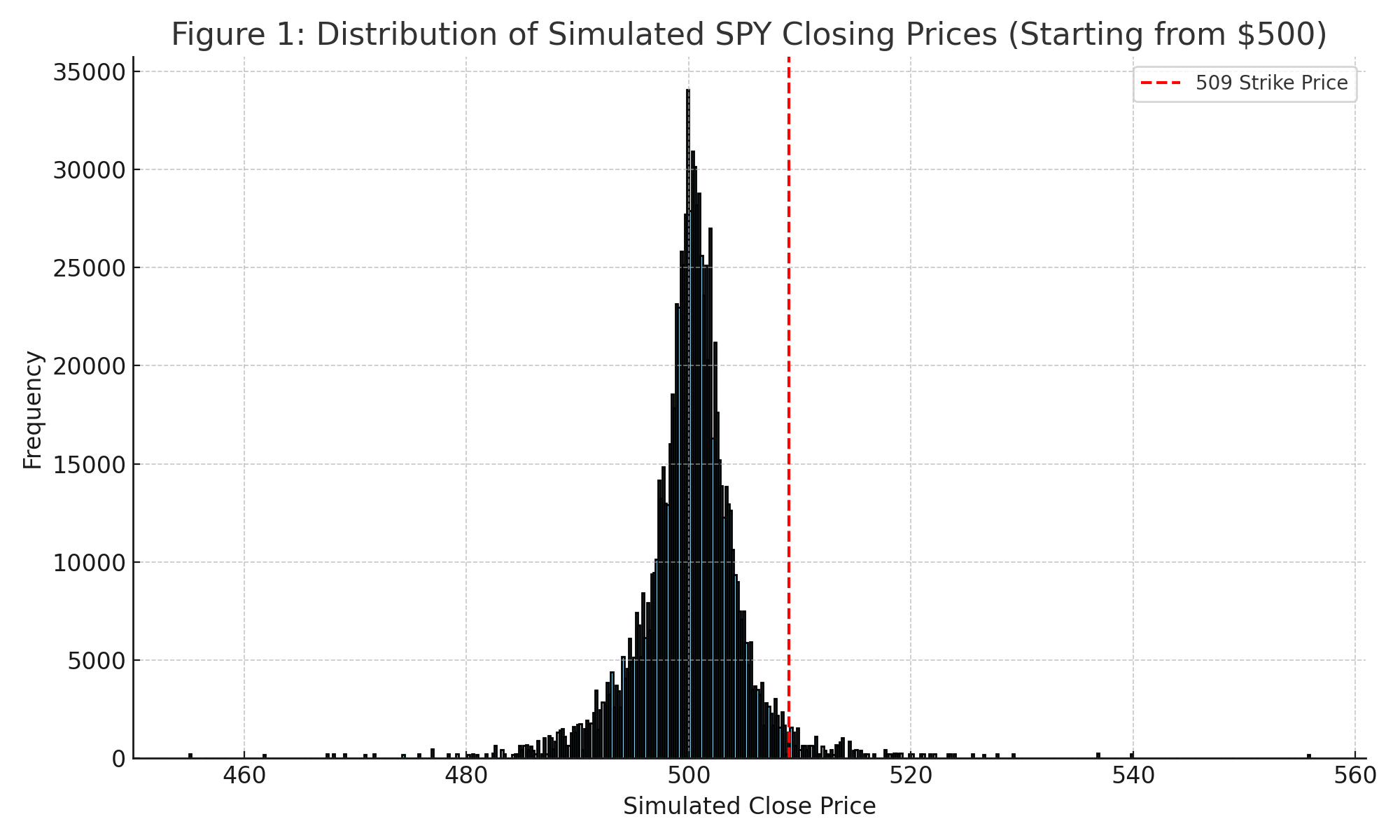

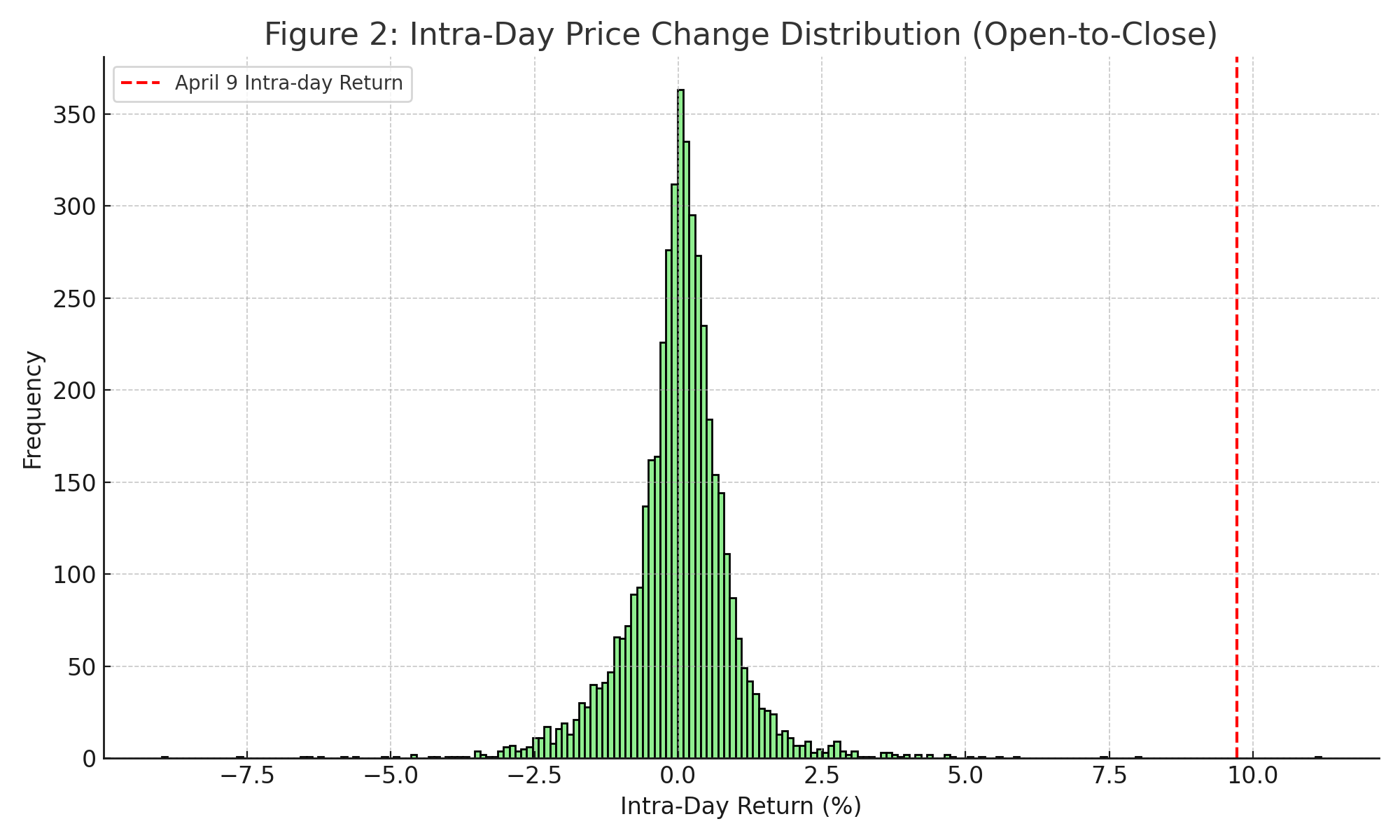

A second question clarified the rarity: How often does SPY rally more than 9% in just a few afternoon hours?

Answer: Never. Across five years, no trading day displayed this extreme level of intra-day growth.

Figure 2: Intra-Day Price Change Distribution (Open-to-Close)

Daily SPY returns usually hover near zero. Moves above 5% are incredibly rare. April 9’s intra-day jump from about $500 to $548.62 sits at the extreme tail end of historical price movements.

A Broader, Coordinated Pattern

The 509 calls were part of a broader, suspicious strategy. Similar aggressive buying occurred at nearby strike prices ($504, $505, $507) in SPY and corresponding options in QQQ.

All these positions emerged swiftly between 12:50 and 1:25 pm — before the news broke at 1:30 pm.

Typical options traders diversify their bets or hedge carefully. But these trades were laser-focused, strategically placed at a precise strike price that guaranteed maximum payoff if — and only if — American markets surged abruptly.

Whoever structured these trades also knew exactly how market dynamics would play out. Options with substantial gamma exposure force market makers to buy underlying shares to hedge, accelerating the price rise in a feedback loop called a "gamma squeeze." This precise market mechanic was clearly anticipated.

The mathematics and timing suggest this was not random speculation; it was trading on non-public information.

Final Thought

Markets don't spontaneously move this dramatically without clear catalysts. Traders rarely risk such precise bets without a substantial edge. April 9, 2025, gave someone an extraordinary edge. We still don't know who or how—but we do know these odds defy natural market behavior.

What happened wasn't luck. It was a meticulously calculated bet leveraging insider knowledge.

This isn't just remarkable—it's alarming. And it calls into question the integrity of the world's most important financial markets.