Placed Before the Memo: Suspicious AAPL Options Bet on a Policy Shift That Hadn’t Happened Yet

On April 11, 2025, traders placed large, targeted call option bets on Apple. That evening, the Trump administration quietly exempted smartphones from tariffs, news not publicized until April 12. These trades weren't speculation - they were placed before the memo was released.

On the afternoon of April 11, 2025, traders began placing large, targeted call option bets on Apple — almost all of them expiring within days.

The positioning was tight: strikes between $195 and $200, when Apple was trading between $194 and $198. By the end of the trading session, tens of thousands of contracts had changed hands, including sweep and block orders sized well into the six figures.

That evening, the Trump administration quietly published updated tariff guidance exempting smartphones, computers, semiconductors, and flat panel display modules from the “reciprocal tariffs.” The memo wasn't publicized until Saturday morning, April 12.

The trades had already been placed.

This wasn’t a hedge. It wasn’t speculation. It was coordinated, timed, and informed. This was insider trading.

What the Trades Looked Like

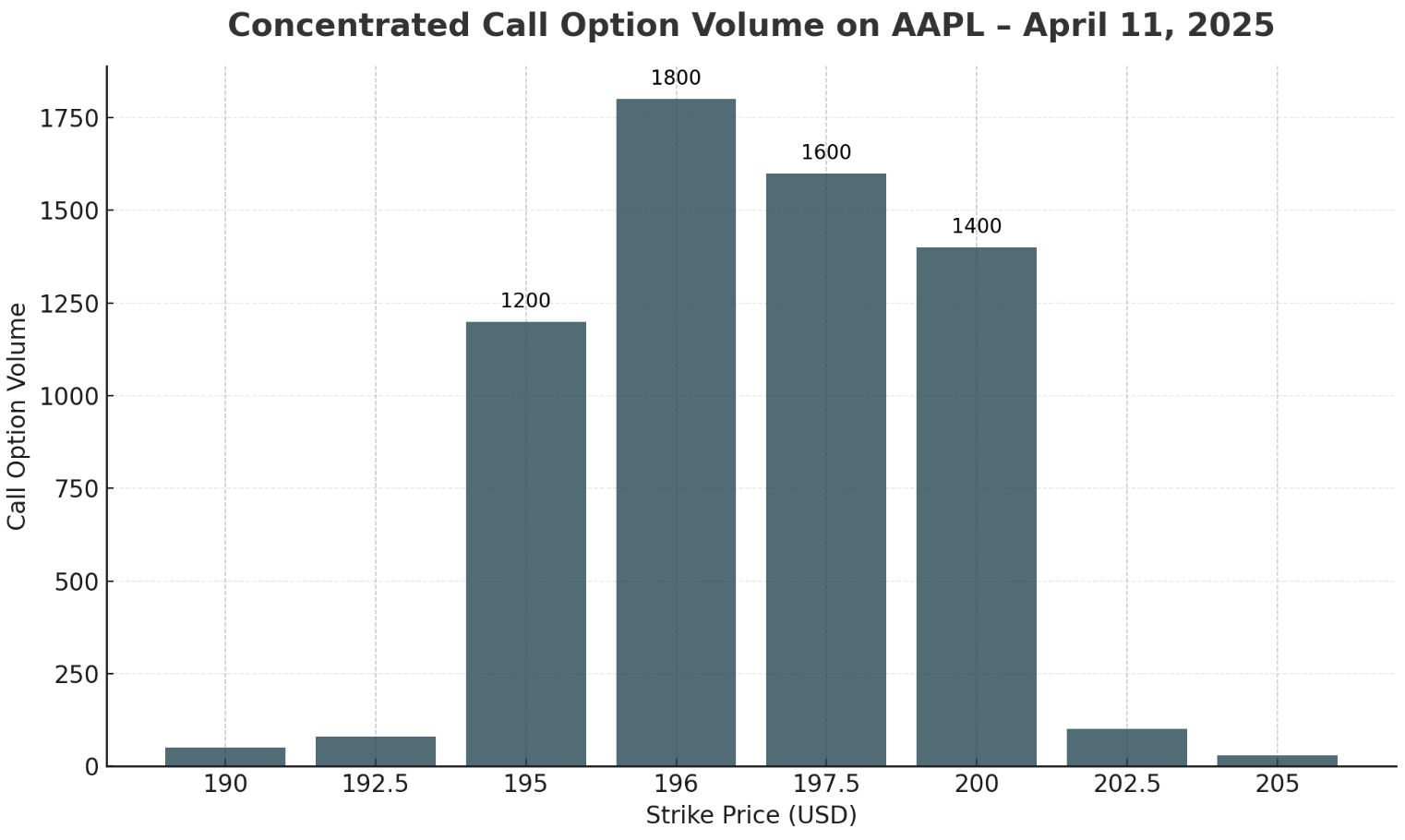

The chart below shows the volume of AAPL call options by strike price on April 11. Nearly all of the activity clustered between $195 and $200 — just above where Apple was trading intraday.

When I say the positioning was “tight,” I mean that nearly all of the option volume was focused in a narrow strike range just above the current share price, and across very short expiries. These contracts only gain value if there’s an immediate and significant upward move.

Without knowledge of an imminent catalyst, trades like this are irrational. You're paying a high premium for contracts that expire almost worthless unless the stock jumps — fast. That kind of setup only makes sense if you know something is about to move the market.

AAPL opened at $211.44 on Monday, April 14 — more than $16 above its Friday close. The 196C contracts, bought for $1.80, opened worth over $15. The 197.5Cs bought at $1.10 hit nearly $14. Even the 202.5Cs, which traded for just $0.15 on Friday, opened at $8.94.

These are no longer theoretical returns. They’re real, extraordinary, and timed down to the hour.

But the structure of the trade speaks for itself.

| Strike | Price Paid (Apr 11) | Value at Open ($211.44) | ROI (%) |

|---|

| 195C | $2.50 | $16.44 | 558% |

| 196C | $1.80 | $15.44 | 758% |

| 197.5C | $1.10 | $13.94 | 1167% |

| 200C | $0.40 | $11.44 | 2760% |

| 202.5C | $0.15 | $8.94 | 5860% |

That’s what makes these trades so striking. They haven’t paid off yet — and may not. But they were built as if someone knew what was coming, and when.

It’s not the payoff that proves intent. It’s the timing.

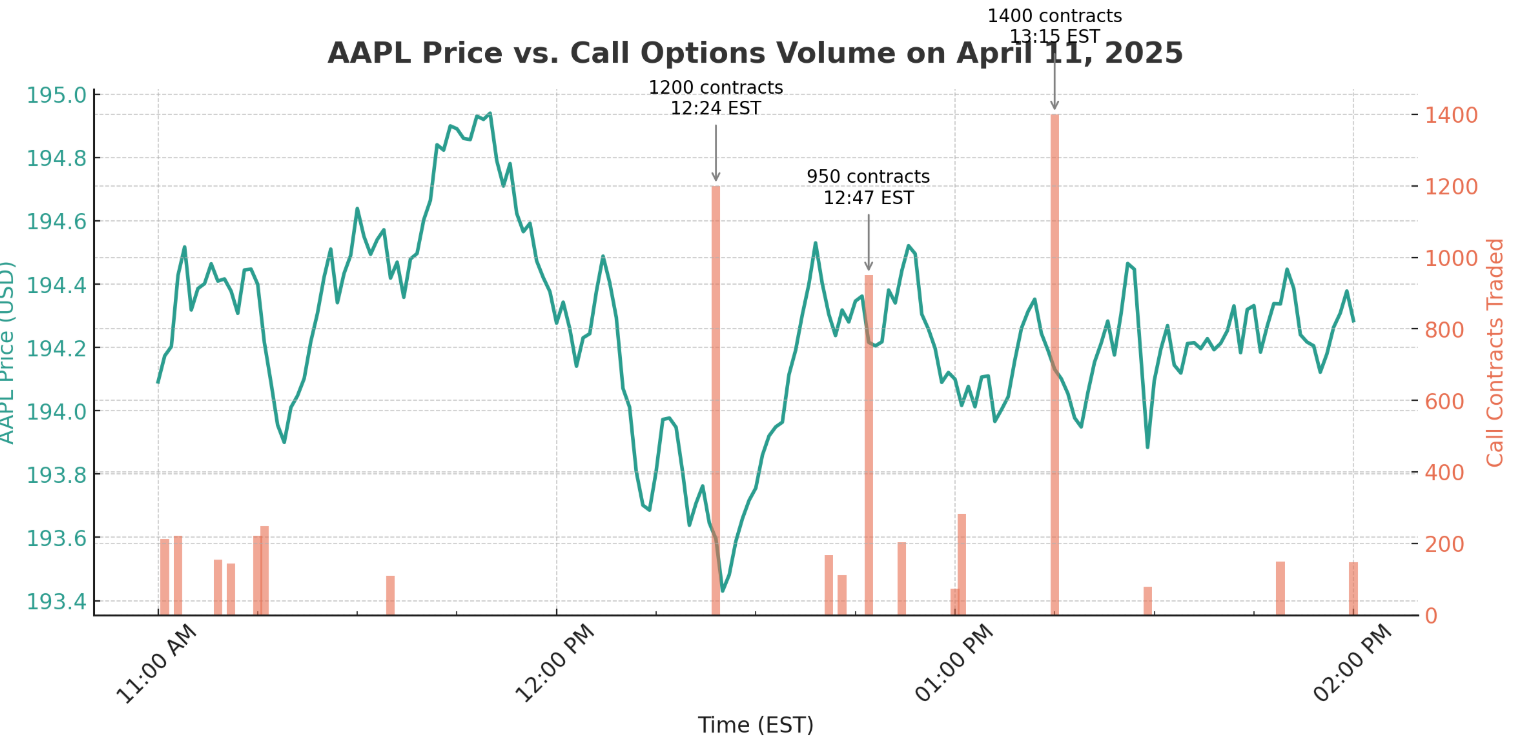

The chart above shows Apple’s share price (teal) alongside call option volume (salmon) over the final hours of trading on April 11. The largest trades clustered between noon and 2 p.m. — after Apple’s price stabilized, but before the memo was released. The traders weren’t responding to a move. They were positioning in advance of it.

This Wasn’t Just Apple

The tariff exemption applied not only to smartphones but to the broader electronics supply chain. Semiconductors. Laptops. Display modules. ETFs like $QQQ and $SMH. We don’t have a full accounting of the trades placed across the sector.

But we don’t need it.

What happened in Apple alone tells the story.

This wasn’t a retail trade gone right. The options were short-dated, high-leverage, and placed in bulk — often using sweep orders, which route across multiple exchanges to avoid detection and slippage.

It’s not enough to call this unusual or suspicious. This is coordinated, institutional-scale insider trading. And we’ve come to expect that no one will look too hard, as long as it’s hidden inside a few contracts here, a few tickers there.

But make no mistake: these trades were built for speed, precision, and access.

They were placed before the memo.

They paid off immediately after it.

And that’s the story.

UPDATED April 14, 2025:

The market has opened. AAPL began trading at $211.44, up more than $16 from Friday’s close. The call options placed on April 11 are now deep in the money. The 196C and 197.5C contracts — bought for under $2 — are now worth more than $13. The 202.5C calls, purchased for pennies, are up nearly 6,000%.

These are no longer hypothetical returns. They’re among the most profitable short-dated trades in recent memory.